Before the emergence of Quick Service Restaurants (QSR) also known as Fast Food Restaurants in Nigeria, small food shops or canteens were the common source of ready to eat food. These food outlets were strategically positioned at street corners and market squares, usually selling a variety of staple food items such as rice, pounded yam, beans, bread, fried-yam, roasted corn, along with drinks ranging from soft drinks to alcoholic beverages. However, with increased urbanisation and rising levels of disposable income, consumers gradually became more sophisticated, demanding services with higher levels of quality, greater convenience and better ambience. This trend gave rise to the emergence of quick service restaurants.

Nigeria’s fast food industry experienced rapid development between 1970 and 1980 with companies such as Kingsway, Leventis and Kas Chicken leading the market. Today, the demand for ready to eat food as well as the number of fast food restaurants has increased significantly due to the lifestyle of many Nigerians that may not always allow for the luxury of home cooked meals. Tastee Fried Chicken, Tantalizers, Chicken Republic, Mr Biggs, Sweet Sensation, Mama Cass among others are now major players in the industry. Global brands such as Kentucky Fried Chicken (KFC) and Dominos have since made an inroad into the market.

Nigeria’s organised fast food industry is currently estimated at N250 billion according to the Association of Fast Food Confectioners of Nigeria (AFFCON) and has grown at an annual rate of 10% over the years. Despite its growth rate, only a few QSRs thrive while many others struggle to survive. Like many businesses in Nigeria, QSRs constantly face challenging business situations. Many grapple with significant infrastructural deficiencies and strive to master the changing dynamics within the fast food market. While some are subject to unfavourable industry regulations others are threatened by stiff competition.

In the last couple of years, Mr Biggs and Tantalizers have had to raise bailout funds to remain in business. With increasing levels of competition, stifling business environment and evolving lifestyle and preferences of consumers, the need for fast food restaurants to adapt, innovate and evolve in response to the new realities of the 21st century QSR business has never been more critical.

Against this backdrop, this article seeks to provide valuable information and insights on the lifestyle, behaviour and preferences of QSR customers that would assist businesses within the industry in their quest for increased consumer intelligence and competitive edge.

Insight on the Nigerian Quick Service Restaurant Customer

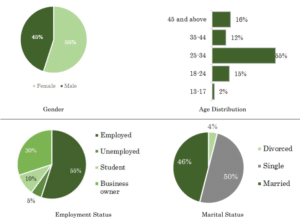

To understand the lifestyle, behaviour and preferences of customers, a survey was conducted in Lagos, focusing on key areas on the Island and Mainland. With a fair representation of the different demographics, 100 randomly selected respondents were interviewed, providing valuable insights on factors that influence their decision to patronise fast food restaurants. Of the total respondents, 55% were female and 45% male; most were between 18 and 34 years old; had at least a post-secondary education; and were in the consuming middle class (individuals with an annual income of more than $7,500). In addition, 46% of the respondents were married with an average family size of four, 50% were single and 4% divorced. Furthermore, 55% of the respondents were employed, 5% unemployed, 10% students and 30% were business owners.